are hearing aids tax deductible in uk

Since hearing loss is. For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return.

Medicare Supplement Plans Are They Tax Deductible

Best Hearing Aids From Audiologists of.

. The provision of equipment and services solely to carry out the duties of the employment where private use is not significant is exempt from a tax charge under Section 316 ITEPA 2003 see. Can medical expenses such as hearing aids be used as tax deductions. Deductions can only be claimed if your total out.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. On the invoice 20 VAT was only payable on less than half the pre tax cost being the aids. So if you need a hearing aid just for your work.

For example if your adjusted gross income is 50000 you can deduct the cost of any allowable medical expenses that exceed 3750. You can calculate the amount youre. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75 percent of your adjusted gross income. By deducting the cost of hearing aids from their taxable income wearers could reduce. Even though hearing aids are tax-deductible in Canada it is no question that the cost of hearing aids is a huge reason for people not wanting to purchase them.

Prices are accurate as. Are Hearing Aid Batteries Tax-Deductible. Not only can you deduct the cost of your.

The rest of the package being the bulk of the cost dispensing services follow up. Expenses related to hearing aids are tax. In the eyes of the federal government virtually all personal medical expensesincluding hearing.

Before making any tax filing decisions. Since hearing aids are medical devices they may qualify for tax deductions based on an individuals income for a given tax year. Medical expenses in general can typically be deducted at the end of the year so long as they match or exceed 75 of your annual income.

Hearing Aid Recycling 6700 Washington Avenue South Eden Prairie MN 55344. For further information please take a look at our website. Many of your medical expenses are considered eligible deductions by the federal government.

In this video I talk about hearing aids and how they can be allowable for tax deductions and VAT. This includes hearing aids. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it.

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

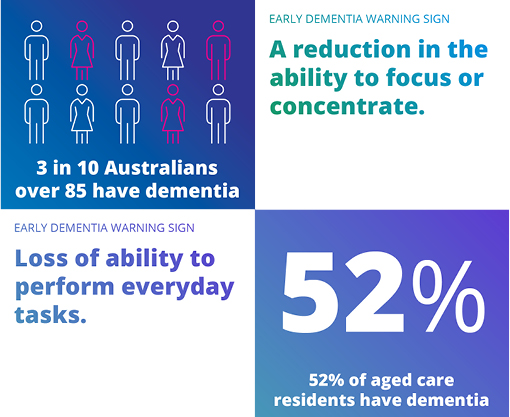

Does Hearing Loss Cause Dementia Better Hearing Australia

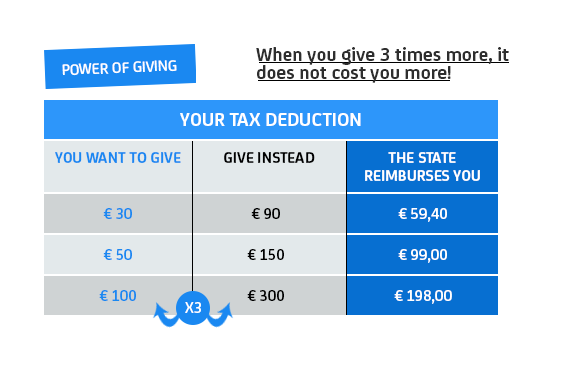

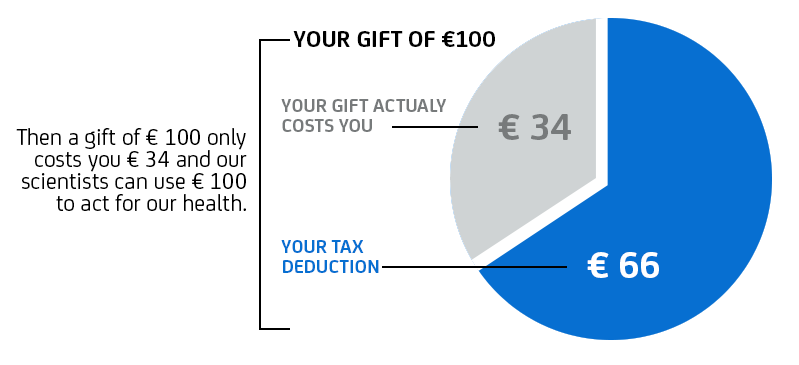

Tax Deductible Donations Institut Pasteur

![]()

Are Hearing Aids Tax Deductible Earpros Uk

5 Tax Write Offs That All Musicians Should Know About Soundfly

Is The Medicare Premium Taxable Rules Income Limits And More

Medical Expenses Often Overlooked As Tax Deductions Cbc News

Is A Medical Alert System Tax Deductible Aginginplace Org

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

Hearing Directory Hearingaidscan Twitter

Five Common Questions To Ask Yourself About Tax Deductible Expenses

How To Deduct Home Care Expenses On My Taxes

Hearing Directory Hearingaidscan Twitter

Is A Medical Alert System Tax Deductible Aginginplace Org

Hearing Can Be Life Changing Be A Miracle Hero Miracles Life Improvement Life Changes

Does Hearing Loss Cause Dementia Better Hearing Australia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More